ESB uses your account currency for managing martingale. Every martingale rally has a risk. This means if the martingale rally fails, a percentage of your account balance is lost. Therefore, every time ESB enters a rally, you accept a risk. You can set a “Minimum Profit to Risk” target. This means you set a percentage of risk as a profit target. When this target is reached, ESB will automatically trigger a clean close. For example, if your account is in USD and your martingale risk is R% with the minimum profit/risk parameter set to P%, then the minimum profit of a martingale rally is P% from R% of the balance. Suppose you set “P” to 20% and Martingale risk (R) to 10%. In this case, if your balance is $10,000, then each stop equates to a $1,000 loss, and the minimum profit is $200. If the maximum attempt is reached, the profit engine uses the next parameter for checking closing profit, which is set to zero by default.

The market is often unstable on Mondays and Fridays, leading some traders to prefer lower risk. Therefore, there are two ratio numbers for Mondays and Fridays: “Monday Profit Ratio” and “Friday Profit Ratio”. ESB multiplies these ratio numbers by the profit for calculating profit on Mondays and Fridays. For instance, if you set the Friday ratio to 0.7, and the target profit on other days of the week is $200, then on Fridays, the target profit will be 0.7 × $200 = $140.

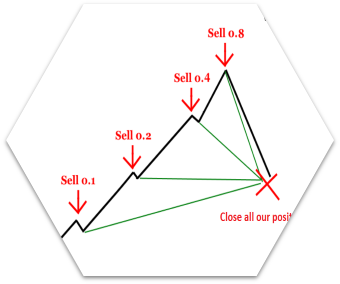

You can set the profit for each step manually by filling in the “Manual Profits” field in a comma-separated format. In this case, ESB will not use the “Minimum Profit to Risk” and “Min Profit/Risk If Max Orders” settings. For example, if you set Manual Profits as: 5,10,15,8,4,0, this means the profit of the first position of the rally is 5% of the risk, the second attempt is 10% of the risk, the third attempt is 15%, the fourth attempt is 8%, the fifth attempt is 4%, and the last attempt has 0% profit. If you do not provide enough numbers, they will default to 0%.