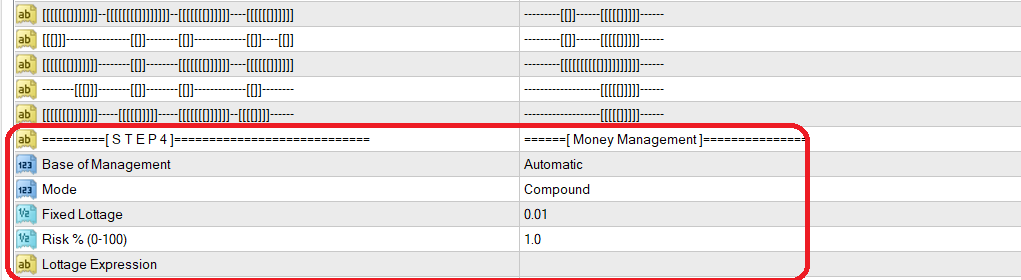

In step 4, you set how your plan manages your deposit and how to compute volume for every position.

First of all, ESB needs to know what the base of its calculations is. This can be determined by the “Base of Management” parameter. If you select “Automatic,” ESB chooses the lowest amount as the base of its calculations to ensure safety and reduce risk. For example, if the total of current positions is in loss, it uses equity, and if we are in profit, it uses balance for money management and the calculation of volume!

There are three modes for the calculation of volume:

Fixed Volume: A fixed lot size for all positions can be set by the “Fixed Lottage” parameter.

Compound: A percentage is set by the “Risk” parameter. The volume of the position is adjusted so that if the stop is reached, your account drawdown will be about this percentage. Suppose you set balance as the base of calculations and your account balance is $10,000, and the Stop Loss of the position is 10 pips. If you set risk at 2% ($200), the volume is set to 0.02 lots. Therefore, if the Stop Loss is reached, the balance is reduced by 2%. Note that if a position doesn’t have a Stop Loss, the volume is calculated by a percentage of the base balance.

Compound by balance: The volume of the position is adjusted by a percentage of the account (balance, equity, or free margin) that is set by the “Risk” parameter.

By Expression: ESB calculates the “Lottage Expression” and uses it as the lot size of the order. If the result of the calculations is zero, it uses Compound Lottage, and if that is also zero, ESB uses Fixed Lottage as the volume of trade.