In terms of price action, break-even is the level at which the risk on the trade is zero. This means that if the trader chooses to close at that particular price, they neither win nor lose. ESB achieves break-even by moving the Stoploss to the open price. In Half-Break-Even, the ESB reduces the Stoploss by half.

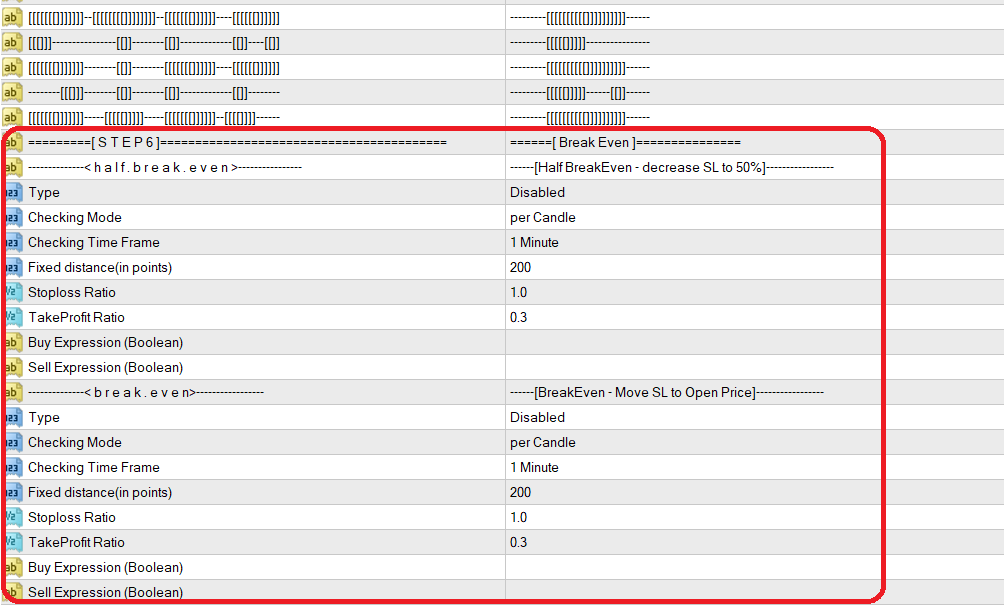

But when does ESB perform break-even or half break-even on an open position? This can be set by the “Mode” parameter. The ESB supports various types of break-even.

- After Fixed Distance: If this mode is selected, ESB performs BE or HBE after the price moves a fixed distance, set by the “Fixed Distance” parameter. This parameter must be set in points.

- By SL Ratio: In this mode, ESB moves the Stoploss after the price moves in profit by a proportion of the Stoploss. This proportion can be set by the “SL Ratio” parameter.

- By TP Ratio: This mode works similarly, but the movement is based on a proportion of the Takeprofit. The proportion is set by the “TP Ratio” parameter.

- Offset: In break-even, ESB moves the Stoploss to the exact open price. The Offset parameter sets the number of points for the distance between the open price and Stoploss. For example, if it is a buy position and the offset is 19, then ESB moves the Stoploss to 19 points higher than the open price. This helps to secure even small profits. If the offset is set to -1, ESB automatically adds the spread and commission to determine the offset. Offset also accepts expressions.

- By Expressions: If BE and HBE of your plan operate under different conditions, you can set them using “Buy/Sell Expression“. ESB checks these conditions, and when they are true, it moves the Stoploss to the open price or reduces the Stoploss to half of its original value.

The ESB can check the conditions for BE and HBE either per candle or per tick. If you choose “per candle” as the value of “Checking Mode“, then set the time frame for checking using the “Checking Time Frame” parameter.